Money talks, says goodbye

Zimbabwe’s second highest denomination note worth two American cents or roughly four cents at the official exchange rate

The political and economic health of a country can be measured by its exchange rate against hard currencies, experts say.

Zimbabwe is a classic example. But first though, see how the formula works. The South African rand took a tumble after the Americans accused its armaments industry of providing weapons to Russia.

The South Africans tried to deny it but then said it was no-one else’s business what they did or with whom they did it, even when the threat of sanctions against them was bandied about.

In February the South Africans held joint naval exercises with Russia and China and sophisticated missiles were fired into make-believe targets at sea. Putin is at war and deals were to follow? Obviously our southern neighbours need all the money they can get.

Last year the ZAR had been fairly constant at about ZAR. 15 to USD. 1. In the initial fallout over Russia it zoomed to 21-1 then recovered slightly to 19-1 this week.

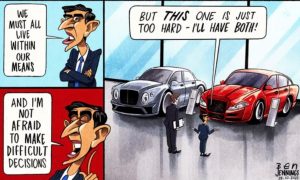

The British pound has had its up and downs too over the recent turnover of prime ministers, finally getting Mr Sunak. Dramatic cost of living increases blamed on the Putin-fueled world energy crisis were also a factor. The GBP improved as UK inflation has dipped to below 10% for the first time in months.

The British pound has had its up and downs too over the recent turnover of prime ministers, finally getting Mr Sunak. Dramatic cost of living increases blamed on the Putin-fueled world energy crisis were also a factor. The GBP improved as UK inflation has dipped to below 10% for the first time in months.

Now take a look at Zimbabwe. We didn’t need a crisis. Every day is a crisis.

Annual inflation is above 600%, depending on the way its calculated, according to independent estimates. That’s more than double the official inflation rate the government admits to.

The offical Zimbabwe dollar exchange rate has gone from ZD 900 to one US to 1,800 to one in the past three weeks.

The offical Zimbabwe dollar exchange rate has gone from ZD 900 to one US to 1,800 to one in the past three weeks.

The official rate is largely ignored, as shown by a can of baked beans in the local supermarket: 4,000-1. The beans may still be cheaper than in the First World but we don’t earn as much if we have jobs at all.

After independence the ZD had held steady at 8-1 for a decade. “Black Friday” came along in 1997 after huge unbudgeted payouts (ZD two billion, in all, when it was 8-1) were given out to protesting veterans of the liberation war who saw their leaders taking fat war and disabilty pensions for themselves alone. The struggling ex-guerrillas had to be placated.

Wthin three days of Black Friday the ZD crashed from 8-1 to 56-1 then 300-1 and more, and the spiral hasn’t stopped.

The Zimbabwe dollar has constantly been on a roller coaster. We do what bankers the world over call ‘quantative easing’ – print more money but which, in the wong hands, leads to chronic hyperinflation and shortages of goods.

The Zimbabwe central bank eventually produced a ZD 100 trillion bank note, the highest single denomination bill since paper money was invented. It could hardly buy a loaf of bread and had to be abandoned in the end for a range of different currency experiments to be tried. We are not an exception for the collapse of a currency. In the Germany of the Third Reich a wheelbarrow of money was needed to go shopping.

In leisure hours this weekend, take 5 minutes to watch a graphic artist’s terrific video telling the whole sorry saga of our repeated failures to get some sanity back. It’s just 5 minutes long and is well worth watching. Nice funeral music too.

Le roi est mort, vive le roi. The more things change the more they stay the same.

Thank you Angus for an excellent article.

Aluta continua !

Thank you Angus.